You can't tell how much your small firm makes by looking at its gross revenue. A company's true gross profit can only be determined after all operating expenses have been deducted from sales revenue. These operating expenses include the cost of raw materials, the cost of purchasing goods at wholesale, and, indeed, the cost of any machinery or other tools used in the production process. The sum of a company's revenues is not the total of its success. Comparatively, a company with annual sales of $1 million but annual costs of $1 million earn less money than one with annual sales of $100,000 but annual expenses of just $10,000. Both gross margin and gross profit may be used as indicators of a company's profitability, but they both have advantages and disadvantages.

Money Made From Sales

Sales revenue is subtracted from selling expenses to determine gross profit. Gross profit is the amount earned after deducting the selling price from the total cost of products. It's the money left over after paying all the bills, including salary and rent, and getting everything else you need. A company's gross profit may be calculated as sales less the cost of goods sold. It is important to remember that almost all profit and loss (P&L) statements must properly identify and itemize gross profit by generally accepted accounting standards (GAAP).

The Term "Gross Margin."

The operating income may be calculated by subtracting operating expenditures from revenue. If your company's gross profit was $250,000 and it generated sales of $500,000, then the gross margin of your firm was 50%.

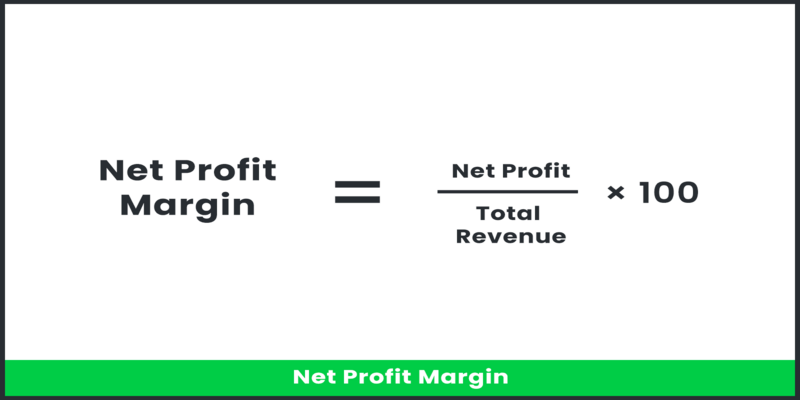

Gross Margin May Be Calculated As (Gross Profit/Sales) X 100

The state of a store's health is an important factor in this analysis. Which shop is superior, A or B, if both generate the same revenue, but A's gross margin is 50%, and B's is 55%? Store B triumphs over the competition because of its superior inventory management. To counter this, it's possible that Store B has greater overhead expenses or pays its staff $2 more each hour than Store A. Company B might have had the same annual net profit as Store A even if it had a higher gross margin (by 5 percentage points). If you need an example to help you understand, here it is. Does the fact that your competitor's TVs have a 40% operating income and yours only have 30% mean that you're doing anything wrong? The issue to remember is that a high gross margin % isn't always indicative of a successful pricing strategy.

Considerations Of Profit And Loss

The store's operating margin or sales will be high or low. Perhaps the profit and loss statement would look the same either way. These figures gauge a business's creditworthiness when applying for a loan or line of credit. Remember that accountants often focus on total net revenue, the sum of money you made "after" deducting all of your business's expenditures. However, many stores' ability to turn a profit is hampered by things like lousy leases and out-of-control costs. Even the most profitable retailers need to understand how to keep expenses down. No matter what you're selling, cash rules in retail, a $3,000 mechanized bed with a voice command, or cheap mattresses.

Conclusion

Compared to sales and COGS, a corporation's gross profit and gross profit margin are strong indicators of its financial health. Since operating expenditures, interest, and taxes aren't included in the ratios, they aren't reliable indicators of profitability. Shareholders and analysts use various banking ratios to evaluate a company's health. To identify patterns, compare the percentages to those of other firms in the same sector and throughout time. A percentage is a gross margin, whereas a number is a gross profit. It is challenging to place gross profit in context without also understanding a firm's other financial indicators (including net sales). If you don't know how much money the firm made within the same period, the gross profit number signifies nothing.